Comprehensive Analysis Suite

Everything you need to understand your business, in one place.

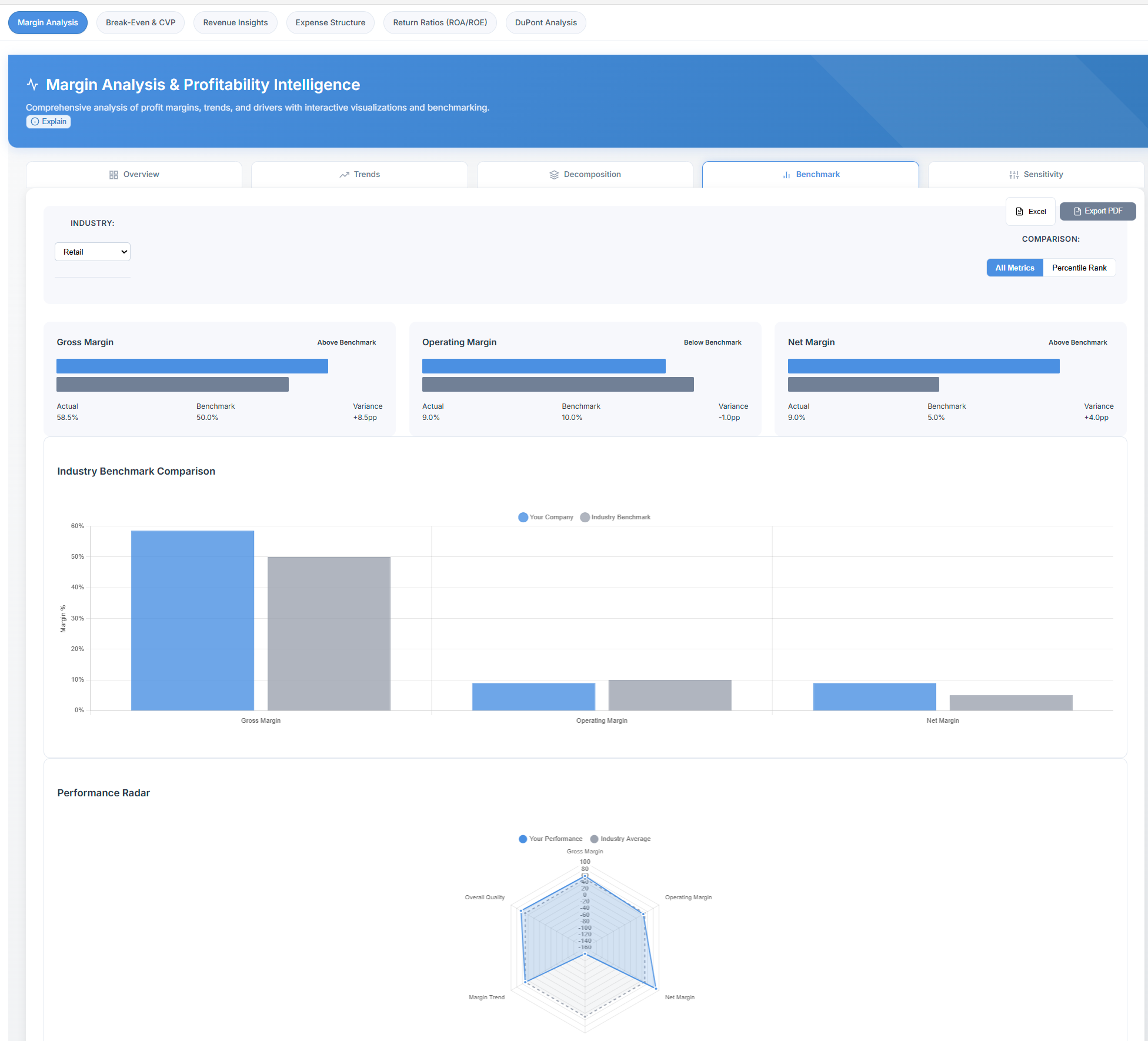

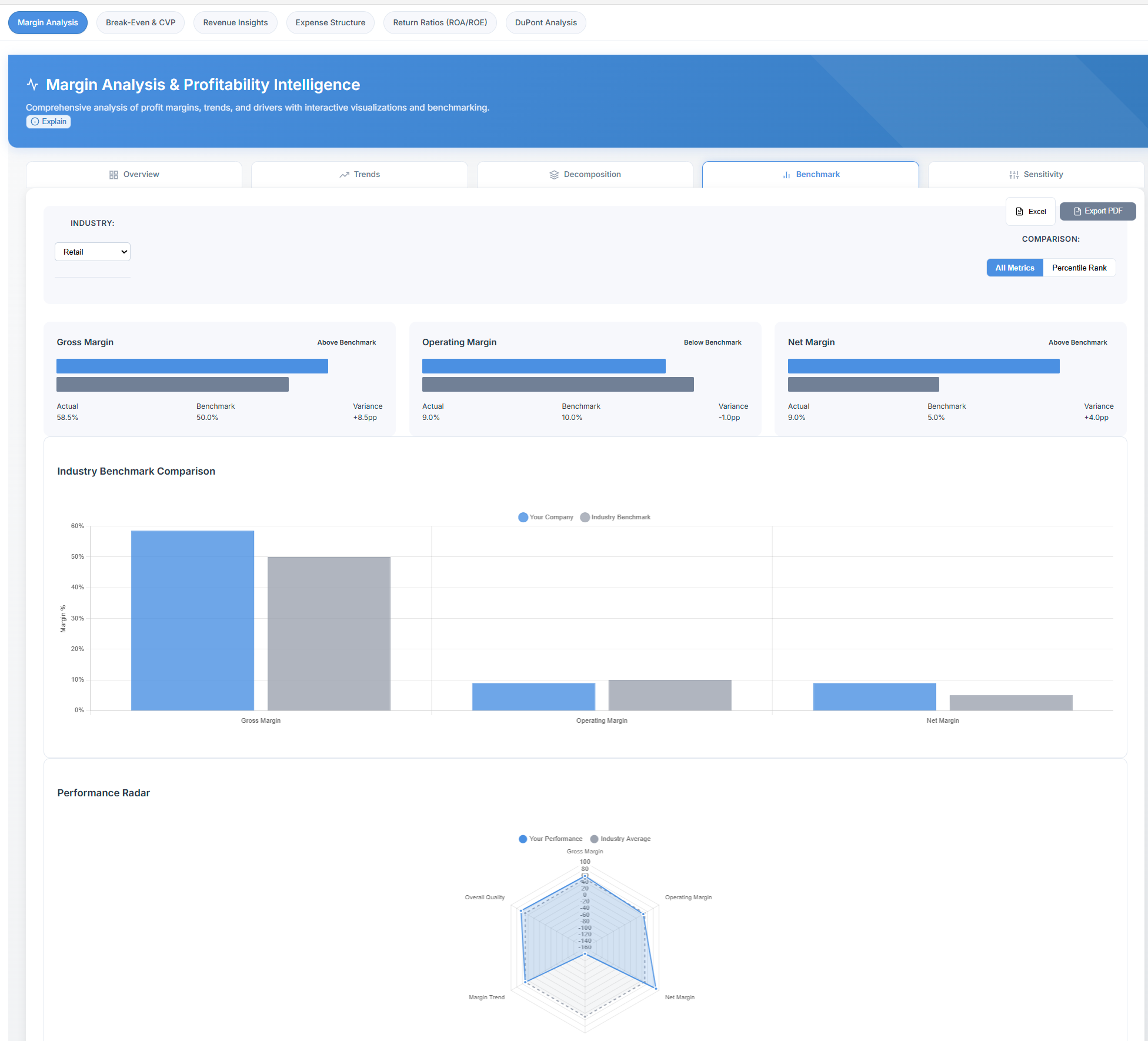

40+ financial metrics using established formulae—Altman Z-Score, DuPont decomposition, CVP analysis, liquidity ratios, and more. Upload a trial balance, receive institutional-grade analysis.

Everything you need to understand your business, in one place.

Use established financial analysis in client meetings to discuss their business position with clarity and precision.

Request a prospect's GL export before the meeting. LedgerIQ calculates 40+ metrics—liquidity ratios, margin analysis, cash conversion cycle—so you can discuss their financial position with specificity.

You're not making claims—you're showing prospects what's already in their numbers. The insight comes from seeing their business through a financial analyst's framework.

"Your Z-Score is 2.1—that places you in the grey zone for financial stress. Here's what's contributing to that score." Specific data, not generalities.

Xero, QuickBooks, Sage, Pandle, or any platform with GL export. Your prospect's software doesn't matter.

Discuss cash conversion cycles, margin erosion, and working capital efficiency—not just compliance deadlines.

Prospect sends GL on Tuesday, you run it Wednesday morning, walk in Wednesday afternoon armed with insights.

Every calculation uses established accounting formulae—Altman Z-Score, DuPont decomposition, Piotroski F-Score, and 35+ more ratios and metrics used by analysts worldwide.

The industry-standard formula for assessing financial distress risk, developed at NYU and validated across 50+ years of corporate data.

Breaks down return on equity into three strategic components, revealing whether returns come from margins, efficiency, or leverage.

Cost-volume-profit analysis with interactive what-if scenarios. See how price changes, cost reductions, or volume shifts affect profitability.

Measures how long cash is tied up in operations—from paying suppliers to collecting from customers. Critical for understanding liquidity stress.

Combines the Altman Z-Score with Piotroski F-Score (9-point fundamental analysis) and liquidity metrics into a single 0-100 health rating.

Intelligent flagging of unusual transactions using materiality thresholds, not just statistical outliers. Catches control violations and structuring patterns.

All formulas are established financial analysis standards—Current Ratio, Quick Ratio, EBITDA margin, Debt-to-Equity, and 35+ more ratios used by analysts and lenders worldwide.

Four simple steps to financial clarity.

Download CSV/XLSX from Xero, QuickBooks, Sage, etc.

Drag & drop into LedgerIQ's encrypted vault.

AI classifies your accounts automatically.

Explore dashboards and download PDF reports.

Meet RiQ, your autonomous AI assistant that doesn't just answer questions – it actively navigates dashboards, analyzes your data, and generates comprehensive reports through natural conversation.

Say "Show me my P&L" and watch RiQ instantly navigate to the Profit & Loss module, wait for it to load, and provide contextual insights.

RiQ reads your actual financial data in real-time. Ask "What's my gross profit margin?" and get instant analysis based on your numbers.

Say "Generate profitability report" and RiQ autonomously visits 10+ modules, collects data, and compiles a professional analysis in minutes.

RiQ detects when account classifications are needed and provides AI-powered suggestions for COGS, assets, liabilities, and more.

Say "I'm worried about cash flow" and RiQ conducts a multi-module tour, explaining insights at each stop like a financial analyst.

RiQ doesn't wait for you to ask. It automatically spots trends, flags anomalies, and suggests next steps based on your data.

"Show me my profitability trends"

"I'll analyze your profitability for you..."

*Navigating to Margin Analysis → Return Ratios → DuPont Analysis*

"Your gross profit margin is 42.3%, up from 38.1% last quarter. Operating margin improved to 18.5%. Your ROE of 15.2% is driven by strong asset turnover. Would you like me to generate a detailed profitability report?"

RiQ understands context, remembers your conversation, and actively works for you.

Traditional Chatbots:

RiQ with LedgerIQ:

Included Analysis Modules

LedgerIQ costs just 500 credits per report. This calculator estimates the time savings compared to manual Excel-based financial analysis.

Start with our Starter plan or explore all tiers for practices and enterprises.

For freelancers and small businesses

2,000 credits/month

Explore Accountant, Practice, and Enterprise tiers with higher limits and advanced features.

Accountant: £15/mo • 10,000 credits

Practice Pro: £79/mo • 75,000 credits

Enterprise: £199/mo • 200,000 credits

Turn prospect GL exports into 40+ financial insights using pure maths—no advisory liability. Show them their business like they've never seen it.

Stop leaving money on the table with inadequate financial analysis. Join businesses using LedgerIQ to unlock their financial potential. Just 500 credits per comprehensive report.

No credit card • No complicated setup • Just instant insights